All Categories

Featured

Table of Contents

Performing swiftly may remain in your finest passion. Additionally, the most generous policies (in some cases called "guaranteed issue") might not pay a fatality advantage if you die of certain health problems throughout the very first two years of insurance coverage. That's to avoid people from acquiring insurance policy immediately after discovering an incurable health problem. Nevertheless, this protection can still cover death from crashes and other reasons, so study the choices available to you.

When you assist relieve the economic concern, friends and family can concentrate on taking care of themselves and organizing a significant memorial as opposed to rushing to locate cash. With this kind of insurance policy, your recipients may not owe tax obligations on the survivor benefit, and the cash can approach whatever they need most.

State Funeral Insurance

for customized whole life insurance coverage Please wait while we get information for you. To discover the items that are readily available please call 1-800-589-0929. Adjustment Place

Eventually, we all need to consider just how we'll pay for a loved one's, or even our own, end-of-life costs. When you offer last cost insurance policy, you can offer your customers with the comfort that features understanding they and their families are planned for the future. You can likewise maximize a substantial chance to optimize your book of service and produce a charitable brand-new income stream! Ready to discover everything you require to understand to begin offering final cost insurance coverage efficiently? No one suches as to consider their own fatality, yet the fact of the matter is funeral services and interments aren't inexpensive (will life insurance pay for funerals).

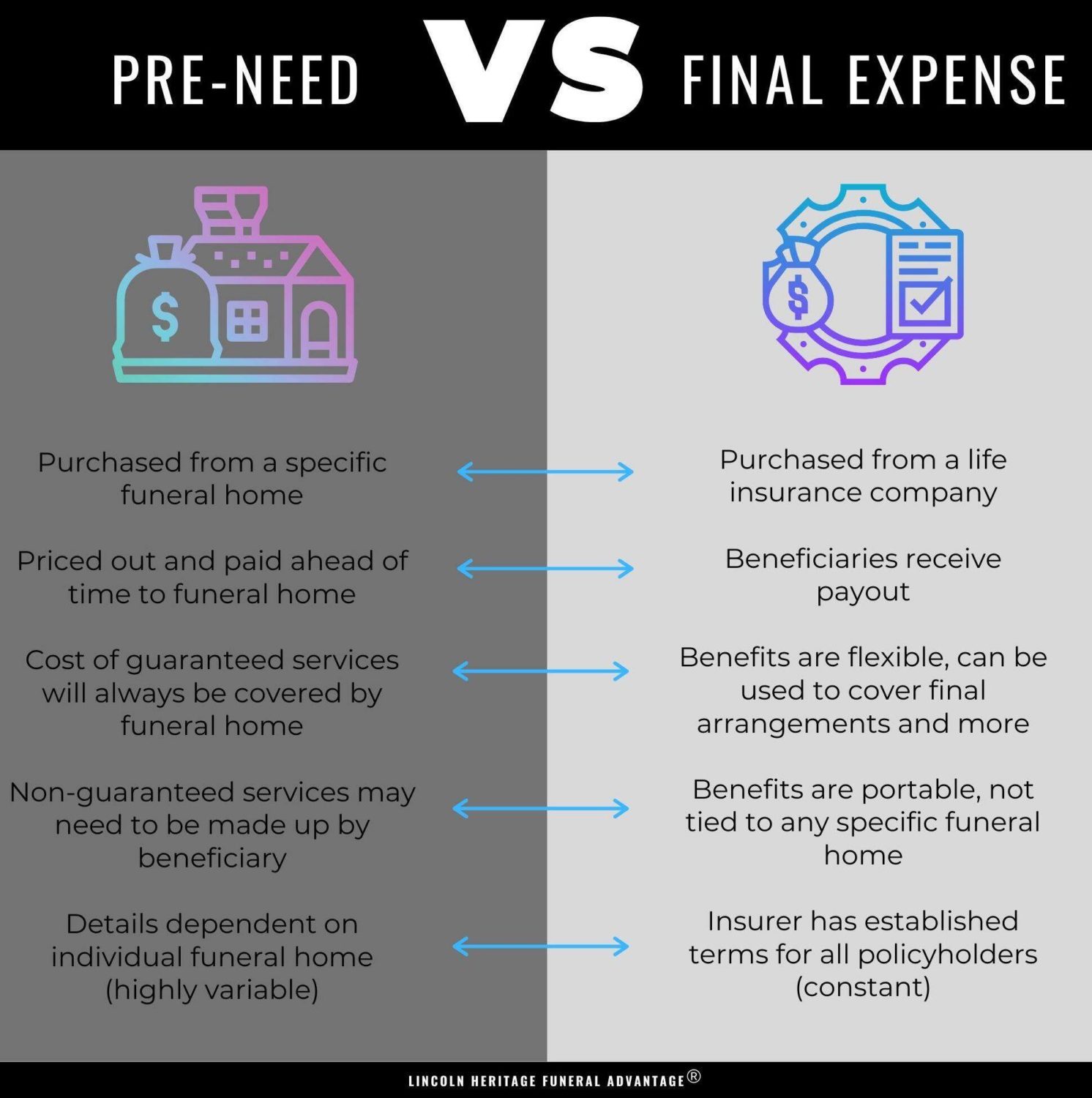

Rather of giving revenue substitute for enjoyed ones (like many life insurance policy plans do), last expenditure insurance coverage is implied to cover the prices connected with the policyholder's watching, funeral, and cremation or funeral. Legitimately, nonetheless, recipients can often use the plan's payment to pay for anything they desire. Normally, this kind of policy is released to people ages 50 to 85, however it can be issued to more youthful or older individuals too.

There are 4 main types of last expenditure insurance policy: ensured concern, rated, modified, and degree (liked or typical score). We'll go more right into detail about each of these product types, however you can gain a fast understanding of the differences in between them by means of the table listed below. Precise benefits and payment timetables might differ depending on the carrier, strategy, and state.

Mutual Of Omaha Final Expense

You're guaranteed protection however at the highest rate. Generally, ensured problem final cost plans are issued to clients with serious or numerous wellness issues that would prevent them from protecting insurance coverage at a basic or graded ranking. burial insurance quote. These health conditions may consist of (however aren't restricted to) kidney illness, HIV/AIDS, organ transplant, active cancer cells treatments, and diseases that restrict life span

Additionally, customers for this sort of strategy can have serious lawful or criminal histories. It is necessary to keep in mind that various service providers provide a range of issue ages on their guaranteed problem plans as low as age 40 or as high as age 80. Some will likewise supply greater face worths, as much as $40,000, and others will enable far better death benefit problems by enhancing the rate of interest with the return of premium or decreasing the variety of years till a full survivor benefit is offered.

If non-accidental death takes place in year two, the provider might just pay 70 percent of the survivor benefit. For a non-accidental fatality in year 3 or later, the provider would possibly pay one hundred percent of the fatality advantage. Changed final expense policies, comparable to rated plans, consider wellness conditions that would position your customer in a much more limiting modified plan.

Some products have details health and wellness concerns that will obtain advantageous treatment from the service provider. There are service providers that will provide plans to more youthful adults in their 20s or 30s who can have chronic conditions like diabetes mellitus. Generally, level-benefit conventional final expense or streamlined issue entire life strategies have the least expensive costs and the largest availability of added motorcyclists that clients can add to policies.

Open Care Final Expense Plans Reviews

Relying on the insurance coverage provider, both a preferred rate class and basic price class might be used - burial insurance for seniors over 75. A client in outstanding health and wellness with no existing prescription medications or wellness conditions may get approved for a recommended rate class with the most affordable premiums possible. A customer healthy even with a few maintenance drugs, however no substantial health and wellness concerns may get approved for common rates

Similar to other life insurance coverage policies, if your customers smoke, utilize various other forms of cigarette or pure nicotine, have pre-existing wellness conditions, or are male, they'll likely need to pay a greater rate for a last cost plan. The older your customer is, the higher their rate for a strategy will be, since insurance policy firms believe they're taking on more threat when they use to guarantee older clients.

Funeral Plan Benefits

The policy will likewise continue to be in pressure as long as the insurance policy holder pays their premium(s). While lots of various other life insurance policy policies might need clinical examinations, parameds, and going to medical professional statements (APSs), final expense insurance policy plans do not.

Simply put, there's little to no underwriting required! That being stated, there are two main sorts of underwriting for final expense strategies: simplified issue and guaranteed concern (life insurance for funeral costs). With simplified problem strategies, clients generally just need to address a couple of medical-related questions and may be denied protection by the carrier based upon those answers

Securus Final Expense

For one, this can permit agents to identify what sort of strategy underwriting would certainly function best for a particular customer. And two, it aids representatives narrow down their client's choices. Some carriers might invalidate customers for protection based upon what medicines they're taking and exactly how lengthy or why they have actually been taking them (i.e., maintenance or treatment).

The brief response is no. A final cost life insurance coverage plan is a sort of irreversible life insurance policy - preneed life insurance. This implies you're covered until you die, as long as you have actually paid all your premiums. While this plan is made to assist your beneficiary spend for end-of-life expenses, they are totally free to make use of the survivor benefit for anything they need.

Much like any type of various other long-term life plan, you'll pay a regular premium for a final expense policy for an agreed-upon death benefit at the end of your life. Each carrier has different regulations and options, yet it's relatively very easy to take care of as your recipients will have a clear understanding of exactly how to spend the cash.

You might not need this kind of life insurance policy. If you have long-term life insurance policy in position your last expenses might already be covered. And, if you have a term life plan, you may be able to transform it to a permanent plan without some of the extra steps of obtaining last cost protection.

End Of Life Insurance Companies

Designed to cover limited insurance policy requirements, this type of insurance policy can be a budget-friendly alternative for people that just desire to cover funeral prices. (UL) insurance policy continues to be in location for your entire life, so long as you pay your premiums.

This option to final expense protection supplies alternatives for added family members coverage when you need it and a smaller protection quantity when you're older.

Neither is the idea of leaving liked ones with unanticipated expenses or financial debts after you're gone. Consider these 5 truths about final costs and exactly how life insurance policy can aid pay for them.

Latest Posts

Sell Final Expense Insurance Over The Phone

New York Life Final Expense Insurance

Best Funeral Plan For Over 50