All Categories

Featured

Table of Contents

Rate of interest will be paid from the date of death to date of repayment. If death is because of natural reasons, fatality profits will be the return of premium, and interest on the premium paid will be at a yearly effective price defined in the policy contract. Disclosures This policy does not guarantee that its proceeds will certainly be adequate to spend for any specific service or product at the time of need or that services or product will certainly be given by any kind of specific company.

A complete declaration of coverage is discovered only in the plan. Dividends are a return of premium and are based on the actual death, expenditure, and financial investment experience of the Company.

Long-term life insurance creates cash money value that can be borrowed. Policy lendings accumulate passion and unpaid plan financings and passion will reduce the fatality advantage and cash money worth of the plan. The amount of cash value available will usually depend upon the type of long-term policy bought, the quantity of insurance coverage purchased, the length of time the plan has actually been in force and any type of superior policy finances.

Our opinions are our own. Funeral insurance policy is a life insurance plan that covers end-of-life expenses.

Interment insurance needs no clinical exam, making it available to those with clinical conditions. The loss of a liked one is emotional and stressful. Making funeral preparations and discovering a method to pay for them while grieving includes another layer of tension. This is where having funeral insurance policy, likewise referred to as final expense insurance coverage, can be found in convenient.

Simplified concern life insurance needs a health evaluation. If your health status disqualifies you from typical life insurance coverage, funeral insurance coverage might be an alternative.

Final Expense Insurance Virginia

, interment insurance comes in a number of kinds. This policy is best for those with moderate to modest health and wellness conditions, like high blood pressure, diabetic issues, or asthma. If you don't desire a clinical examination but can qualify for a simplified issue plan, it is normally a far better offer than an assured concern plan because you can get even more protection for a cheaper costs.

Pre-need insurance coverage is high-risk since the recipient is the funeral home and protection specifies to the selected funeral chapel. Should the funeral home go out of business or you vacate state, you may not have insurance coverage, which beats the purpose of pre-planning. In addition, according to the AARP, the Funeral Consumers Partnership (FCA) suggests against getting pre-need.

Those are essentially interment insurance plan. For ensured life insurance policy, premium estimations depend on your age, sex, where you live, and insurance coverage quantity. Understand that insurance coverage amounts are limited and vary by insurance company. We found example quotes for a 51-year-woman for $25,000 in protection living in Illinois: You may choose to choose out of burial insurance coverage if you can or have conserved up adequate funds to settle your funeral service and any kind of outstanding financial obligation.

Mutual Of Omaha Final Expense Brochure

Funeral insurance uses a streamlined application for end-of-life coverage. Many insurance companies need you to talk to an insurance coverage agent to apply for a plan and obtain a quote.

The objective of having life insurance coverage is to alleviate the burden on your enjoyed ones after your loss. If you have a supplemental funeral plan, your loved ones can use the funeral policy to deal with last expenses and obtain an instant dispensation from your life insurance policy to deal with the mortgage and education costs.

People who are middle-aged or older with medical conditions may consider interment insurance coverage, as they may not get approved for standard policies with stricter approval standards. Furthermore, burial insurance can be valuable to those without considerable cost savings or standard life insurance policy protection. funeral policy cover. Interment insurance coverage differs from various other sorts of insurance coverage because it supplies a lower fatality benefit, generally only enough to cover expenses for a funeral service and other connected prices

News & World Record. ExperienceAlani is a previous insurance fellow on the Personal Finance Insider group. She's assessed life insurance policy and pet dog insurance coverage companies and has created numerous explainers on traveling insurance, credit scores, financial obligation, and home insurance coverage. She is enthusiastic regarding demystifying the complexities of insurance coverage and various other personal finance topics to make sure that viewers have the details they need to make the best cash decisions.

What Is Final Expense

Last expenditure life insurance policy has a number of benefits. Final expense insurance is often recommended for seniors who might not qualify for traditional life insurance coverage due to their age.

On top of that, last expenditure insurance is helpful for individuals who intend to spend for their very own funeral. Funeral and cremation solutions can be pricey, so last expense insurance policy provides comfort recognizing that your enjoyed ones will not need to use their savings to spend for your end-of-life setups. However, final expenditure insurance coverage is not the most effective product for every person.

You can look into Principles' guide to insurance policy at various ages (burial insurance for parents over 80) if you need help determining what type of life insurance policy is best for your phase in life. Obtaining entire life insurance coverage with Ethos is fast and very easy. Coverage is available for senior citizens in between the ages of 66-85, and there's no medical examination called for.

Based on your feedbacks, you'll see your approximated rate and the amount of protection you receive (between $1,000-$ 30,000). You can acquire a policy online, and your coverage starts instantaneously after paying the very first premium. Your price never ever changes, and you are covered for your whole life time, if you proceed making the monthly payments.

Funeral Insurance For Seniors Over 80

Last cost insurance provides advantages yet calls for careful consideration to identify if it's ideal for you. Life insurance can attend to a range of economic requirements. Life insurance policy for final expenditures is a kind of permanent life insurance policy made to cover expenses that develop at the end of life - cheapest funeral cover for parents. These policies are fairly easy to certify for, making them perfect for older individuals or those that have wellness issues.

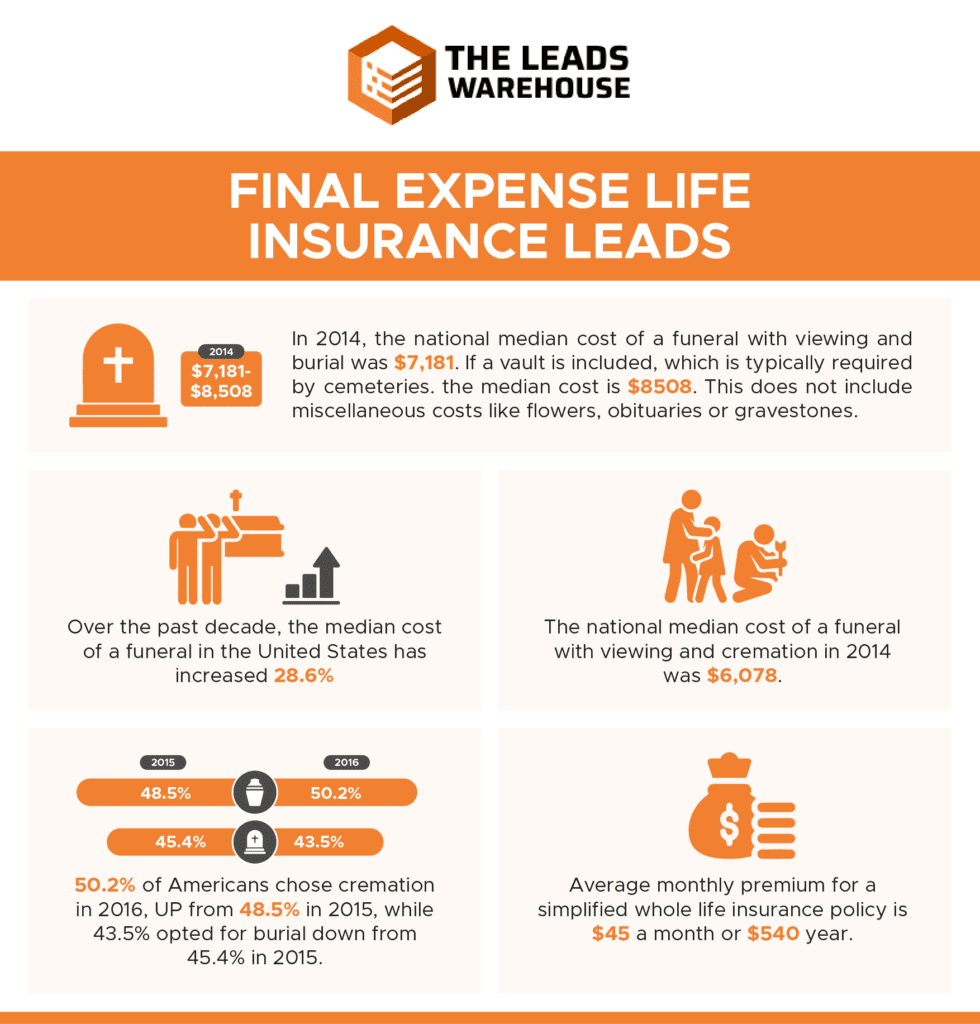

According to the National Funeral Directors Organization, the average expense of a funeral service with funeral and a viewing is $7,848.1 Your liked ones could not have accessibility to that much cash after your fatality, which can include to the anxiety they experience. In addition, they might run into other costs associated to your death.

It's typically not pricey and relatively simple to get (burial insurance meaning). Last expense coverage is sometimes called interment insurance policy, however the cash can pay for basically anything your loved ones need. Beneficiaries can utilize the survivor benefit for anything they require, enabling them to resolve one of the most pressing monetary priorities. In a lot of cases, loved ones invest cash on the adhering to products:: Pay for the funeral or cremation, seeing, venue leasing, officiant, blossoms, providing and extra.

: Hire experts to help with managing the estate and browsing the probate process.: Liquidate accounts for any end-of-life therapy or care.: Repay any kind of various other financial debts, including car loans and debt cards.: Beneficiaries have full discernment to make use of the funds for anything they require. The money could even be made use of to produce a legacy for education costs or given away to charity.

Latest Posts

Sell Final Expense Insurance Over The Phone

New York Life Final Expense Insurance

Best Funeral Plan For Over 50