All Categories

Featured

Table of Contents

Interest will be paid from the date of fatality to date of settlement. If death is due to natural reasons, death proceeds will be the return of premium, and rate of interest on the costs paid will certainly go to a yearly effective price specified in the plan contract. Disclosures This plan does not ensure that its profits will be adequate to pay for any particular solution or merchandise at the time of need or that services or goods will certainly be given by any kind of certain carrier.

A total statement of insurance coverage is found only in the plan. Dividends are a return of premium and are based on the real death, expenditure, and investment experience of the Company.

Long-term life insurance policy establishes money value that can be borrowed. Policy finances build up interest and overdue policy car loans and interest will certainly reduce the survivor benefit and cash value of the policy. The amount of money worth offered will normally depend on the kind of long-term policy purchased, the amount of protection acquired, the size of time the policy has actually been in pressure and any kind of impressive plan car loans.

Associate links for the products on this web page are from companions that compensate us (see our advertiser disclosure with our list of companions for more information). Our point of views are our own. See exactly how we rank life insurance policy items to write honest product evaluations. Interment insurance is a life insurance policy plan that covers end-of-life expenditures.

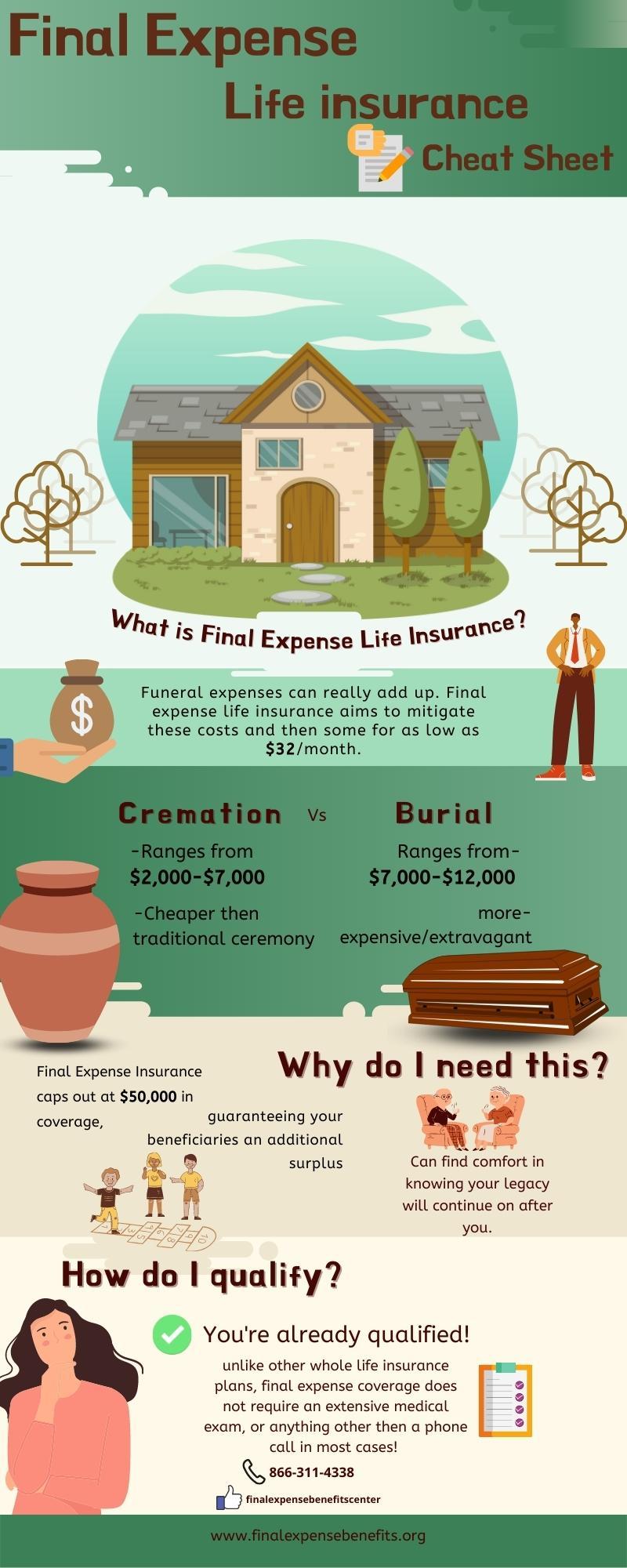

Funeral insurance policy requires no clinical test, making it accessible to those with clinical conditions. This is where having funeral insurance, likewise understood as final expense insurance coverage, comes in useful.

Nonetheless, streamlined problem life insurance policy calls for a health and wellness analysis. If your health and wellness standing disqualifies you from traditional life insurance, burial insurance might be a choice. In enhancement to fewer wellness examination needs, burial insurance coverage has a quick turnaround time for authorizations. You can get coverage within days or perhaps the exact same day you use.

Burial Insurance For Young Adults

, funeral insurance coverage comes in numerous forms. This policy is best for those with moderate to moderate health conditions, like high blood pressure, diabetic issues, or bronchial asthma. If you don't want a medical examination however can qualify for a simplified concern policy, it is normally a much better offer than a guaranteed concern policy due to the fact that you can obtain more protection for a more affordable premium.

Pre-need insurance coverage is high-risk because the beneficiary is the funeral chapel and insurance coverage specifies to the picked funeral chapel. Needs to the funeral chapel go out of service or you vacate state, you might not have insurance coverage, and that defeats the objective of pre-planning. In addition, according to the AARP, the Funeral Service Consumers Alliance (FCA) discourages getting pre-need.

Those are essentially burial insurance policies. For ensured life insurance policy, premium calculations depend on your age, sex, where you live, and insurance coverage amount.

Seniors Funeral Insurance Quote

Funeral insurance supplies a simplified application for end-of-life protection. Many insurance provider require you to talk to an insurance representative to obtain a policy and acquire a quote. The insurance coverage representatives will certainly request your personal info, get in touch with info, monetary details, and insurance coverage choices. If you choose to purchase an assured problem life plan, you will not need to undergo a medical examination or survey - cremation insurance plans.

The goal of living insurance policy is to reduce the burden on your enjoyed ones after your loss. If you have an extra funeral plan, your liked ones can utilize the funeral policy to take care of last expenses and obtain an instant disbursement from your life insurance policy to handle the home loan and education expenses.

Individuals that are middle-aged or older with clinical conditions may think about interment insurance coverage, as they could not receive traditional plans with stricter approval requirements. Additionally, burial insurance coverage can be valuable to those without comprehensive savings or traditional life insurance policy protection. burial funeral insurance. Burial insurance policy differs from other types of insurance coverage in that it provides a lower fatality benefit, normally only enough to cover expenditures for a funeral and various other associated costs

ExperienceAlani is a previous insurance fellow on the Personal Money Insider group. She's evaluated life insurance policy and animal insurance coverage companies and has actually written numerous explainers on travel insurance policy, credit, financial debt, and home insurance policy.

Final Expense Quoting Software

The more coverage you obtain, the greater your premium will be. Last expense life insurance policy has a number of benefits. Specifically, everyone who applies can obtain approved, which is not the case with other kinds of life insurance policy. Last expense insurance coverage is frequently suggested for senior citizens who may not receive traditional life insurance policy because of their age.

Furthermore, last cost insurance coverage is helpful for people who intend to spend for their very own funeral. Interment and cremation solutions can be pricey, so final expenditure insurance policy provides assurance recognizing that your liked ones won't need to use their cost savings to pay for your end-of-life arrangements. Last cost coverage is not the finest product for everyone.

You can examine out Values' overview to insurance coverage at different ages (funeral policy for over 75) if you need help determining what sort of life insurance is best for your phase in life. Getting entire life insurance policy through Ethos is fast and easy. Insurance coverage is available for elders in between the ages of 66-85, and there's no medical examination required.

Based upon your feedbacks, you'll see your approximated price and the quantity of coverage you receive (between $1,000-$ 30,000). You can acquire a policy online, and your insurance coverage starts immediately after paying the very first premium. Your rate never alters, and you are covered for your entire lifetime, if you proceed making the regular monthly settlements.

Funeral Funds For Seniors

Last expenditure insurance policy offers benefits but needs cautious consideration to figure out if it's best for you. Life insurance for last expenses is a kind of long-term life insurance created to cover prices that emerge at the end of life.

According to the National Funeral Service Supervisors Organization, the typical price of a funeral with burial and a watching is $7,848.1 Your liked ones may not have accessibility to that much cash after your fatality, which can include in the stress they experience. Additionally, they may run into other costs connected to your passing.

It's normally not pricey and reasonably simple to get (pre burial insurance). Final expenditure protection is sometimes called interment insurance coverage, but the cash can spend for virtually anything your loved ones need. Recipients can make use of the death benefit for anything they need, enabling them to deal with one of the most pressing economic top priorities. Oftentimes, enjoyed ones spend money on the following things:: Spend for the funeral or cremation, seeing, location rental, officiant, flowers, catering and much more.

: Hire specialists to aid with handling the estate and browsing the probate process.: Close out make up any kind of end-of-life therapy or care.: Repay any various other financial debts, including automobile fundings and credit history cards.: Recipients have full discretion to utilize the funds for anything they require. The cash can also be utilized to produce a tradition for education and learning expenses or given away to charity.

Latest Posts

Sell Final Expense Insurance Over The Phone

New York Life Final Expense Insurance

Best Funeral Plan For Over 50